Investing as a Business Owner

Investing as a Business Owner

Many business owners have built up earnings in their corporation and are looking for tax efficient ways to pull the earnings out to achieve their personal and business financial goals such as:

-

building and protecting your savings

-

providing for loved ones

-

planning for retirement

Factors to consider when investing as a corporation:

What’s the purpose of the investment? First, think about what you’ll be doing with your savings. This will help dictate what savings vehicle is best suited for your situation. Then consider the following factors:

-

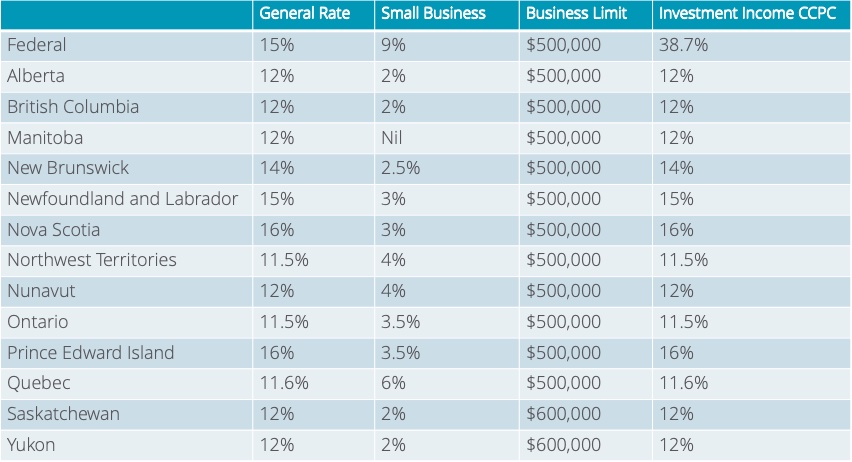

Taxes: As a small business owner, you have access to the small business tax rate which is typically lower than your personal tax rate. (See table below.) Also, as of January 1, 2019, the Federal Budget decreased the small business limit for corporations with a set threshold of income generated from passive investments.

2019 Corporate Income Tax Rates

-

Taxes on investment growth: Depending on what you invest in, you will want to review this as different asset types are taxed at different rates.

-

Timing: You can control the timing of the payout which means you could potentially defer paying out the money until you need it and determine if you’d like to pay it out as salary or dividend.

-

Creditor Protection: Sometimes, investments held inside a corporation can be vulnerable to creditors, therefore you may want to consider using a holding company or trust or pay out money to yourself personally. This can be complex and requires professional advice.

-

Capital Gains Exemption: If your investment grows too large, it may endanger your qualification for the lifetime capital gains exemption that ‘s available when shares of a qualified small business corporation are sold or transferred.

For business owners, before investing personally or corporately, it’s certainly worth seeking professional advice to ensure that it suits your individual circumstances.