On March 18th, the Prime Minister, Justin Trudeau, announced a further $82 billion in support including $27 billion in direct support for Canadian workers and businesses. This is in addition to the $20 billion announced days earlier which includes $10 billion available through the Business Development Bank of Canada (BDC) to help small and medium-sized businesses.

To Support Canadians

Temporary Income Support for Workers and Parents

For Canadians without paid sick leave (or similar workplace accommodation) who are sick, quarantined or forced to stay home to care for children, the Government is:

-

Waiving the one-week waiting period for those individuals in imposed quarantine that claim Employment Insurance (EI) sickness benefits. This temporary measure will be in effect as of March 15, 2020.

-

Waiving the requirement to provide a medical certificate to access EI sickness benefits.

-

Introducing the Emergency Care Benefit providing up to $900 bi-weekly, for up to 15 weeks. This flat-payment Benefit would be administered through the Canada Revenue Agency (CRA) and provide income support to:

-

Workers, including the self-employed, who are quarantined or sick with COVID-19 but do not qualify for EI sickness benefits.

-

Workers, including the self-employed, who are taking care of a family member who is sick with COVID-19, such as an elderly parent, but do not quality for EI sickness benefits.

-

Parents with children who require care or supervision due to school closures, and are unable to earn employment income, irrespective of whether they qualify for EI or not.

Application for the Benefit will be available in April 2020, and require Canadians to attest that they meet the eligibility requirements. They will need to re-attest every two weeks to reconfirm their eligibility. Canadians will select one of three channels to apply for the Benefit:

-

by accessing it on their CRA MyAccount secure portal;

-

by accessing it from their secure My Service Canada Account; or

-

by calling a toll free number equipped with an automated application process. Number to be provided

Longer-Term Income Support for Workers

For Canadians who lose their jobs or face reduced hours as a result of COVID’s impact, the Government is:

-

Introducing an Emergency Support Benefit delivered through the CRA to provide up to $5.0 billion in support to workers who are not eligible for EI and who are facing unemployment.

-

Implementing the EI Work Sharing Program, which provides EI benefits to workers who agree to reduce their normal working hour as a result of developments beyond the control of their employers, by extending the eligibility of such agreements to 76 weeks, easing eligibility requirements, and streamlining the application process. This was announced by the Prime Minister on March 11, 2020.

Income Support

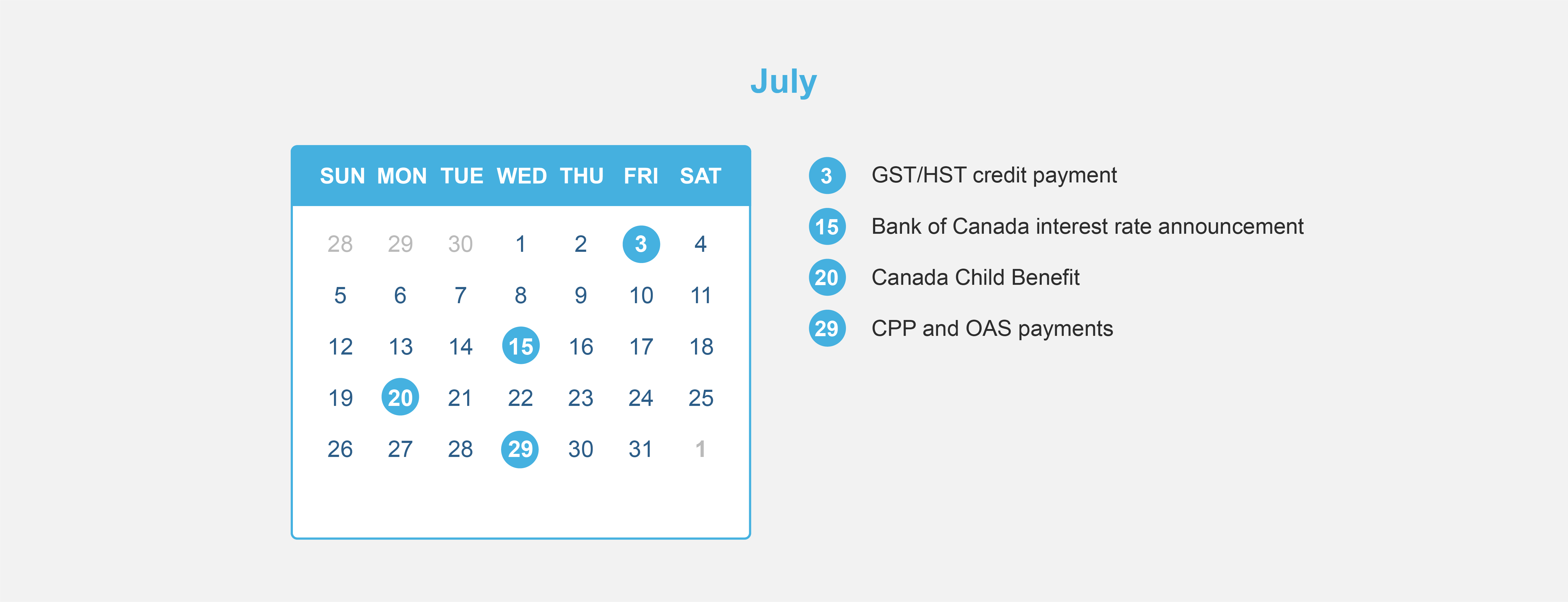

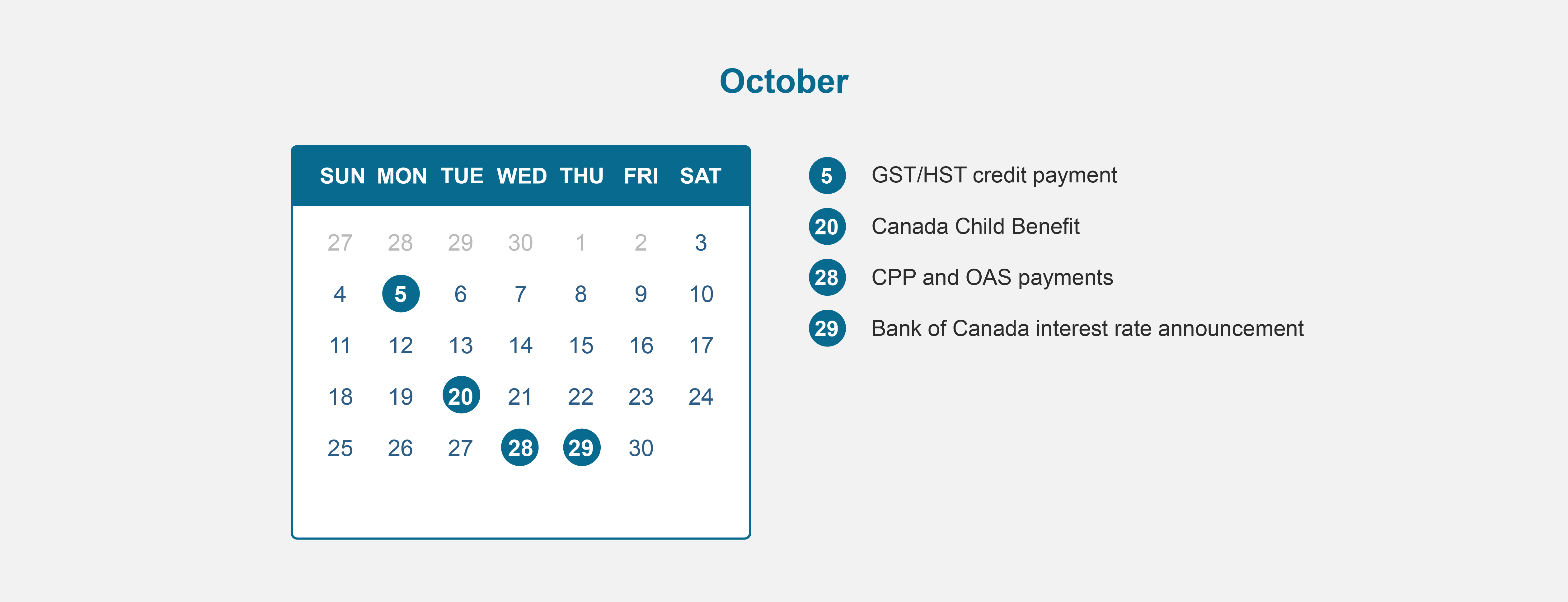

For low and modest income families, the federal government will double the maximum annual Goods and Services Tax Credit (GSTC), providing an average income boost of:

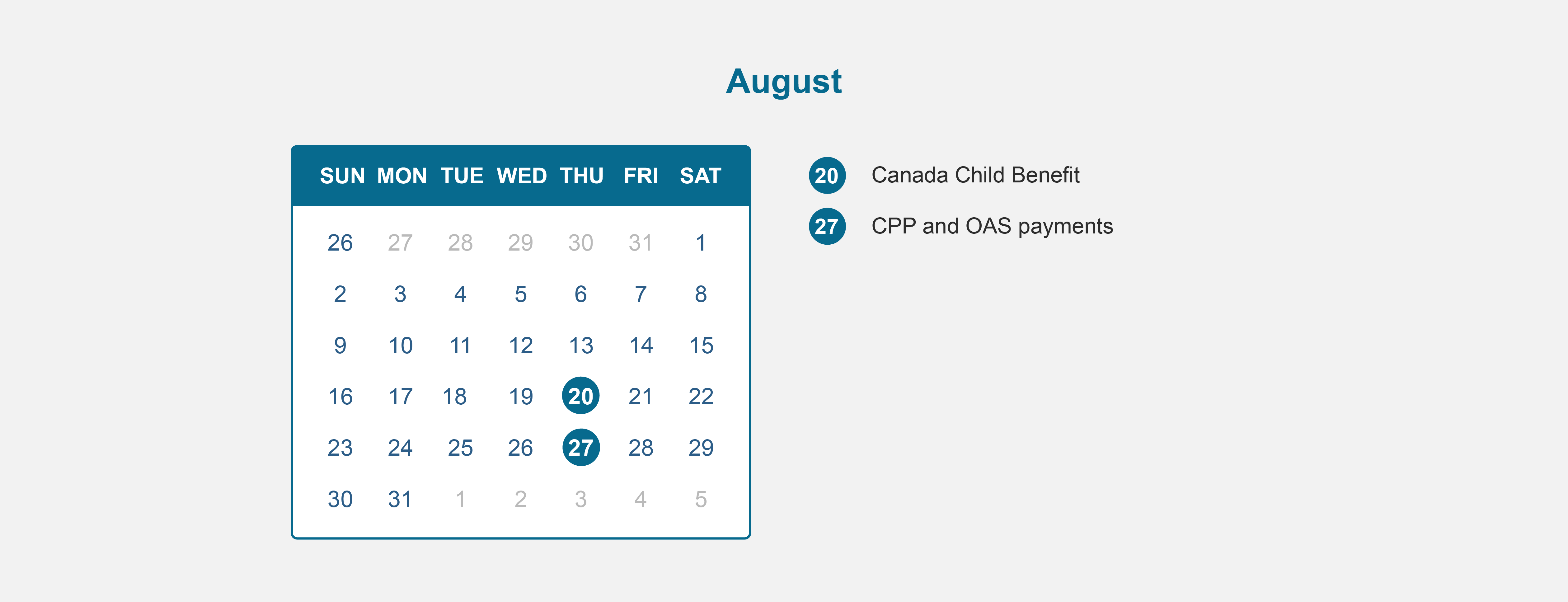

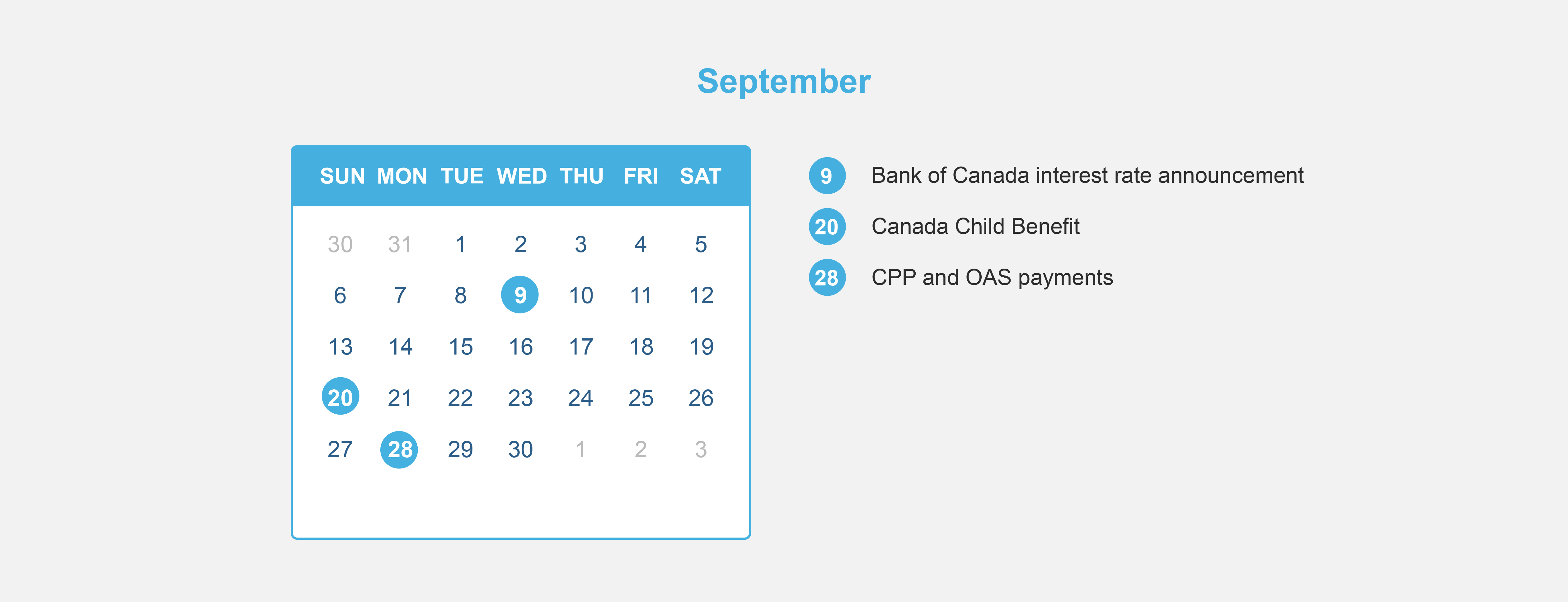

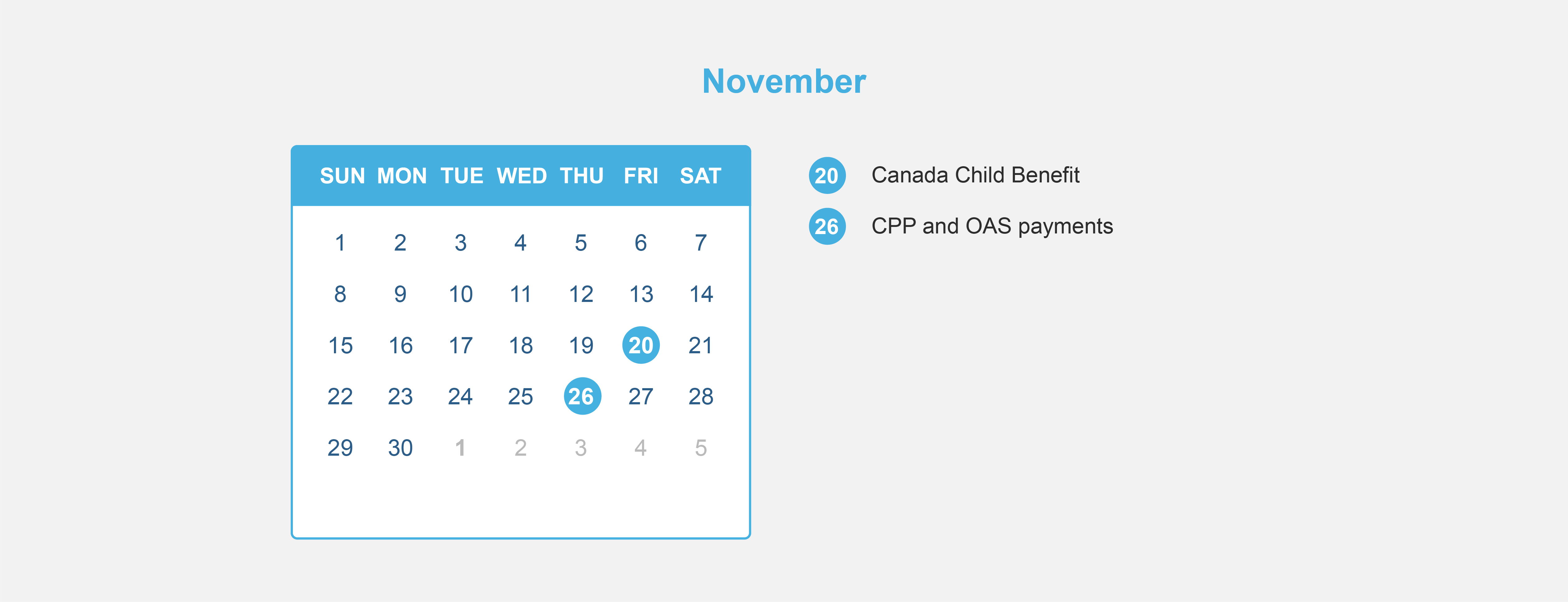

Canada Child Benefit (CCB)

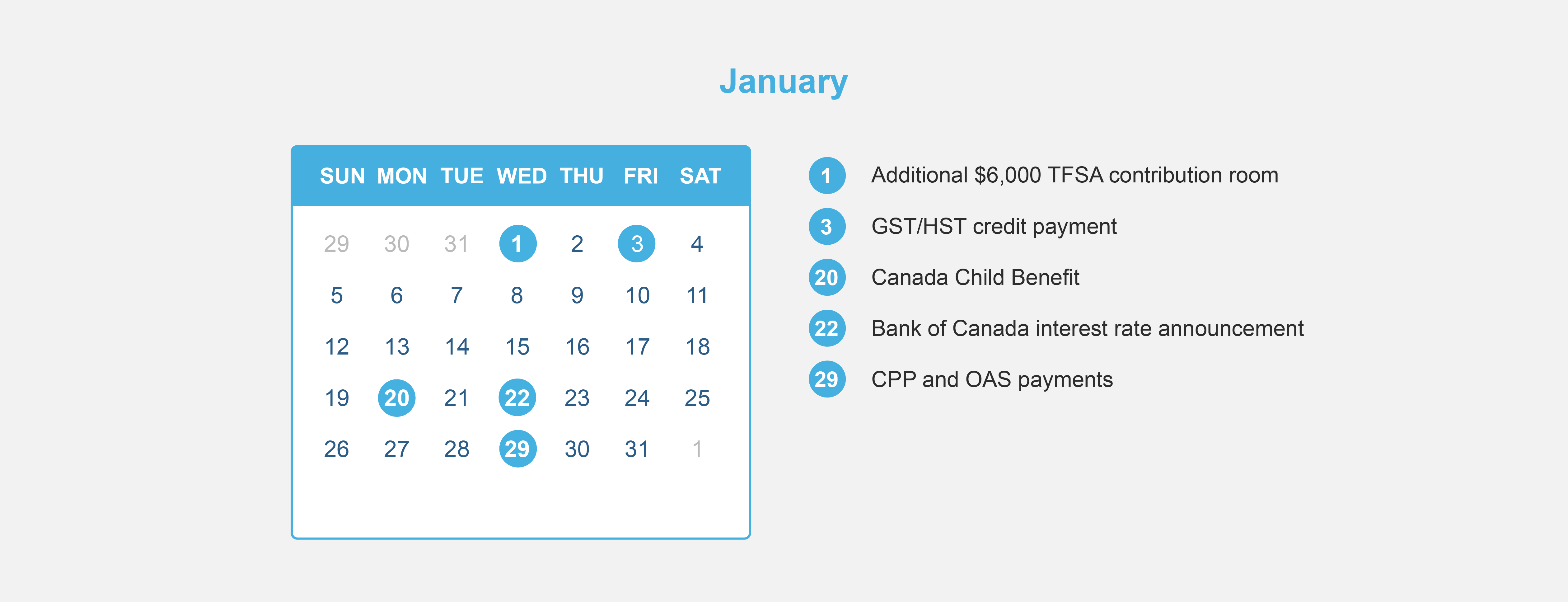

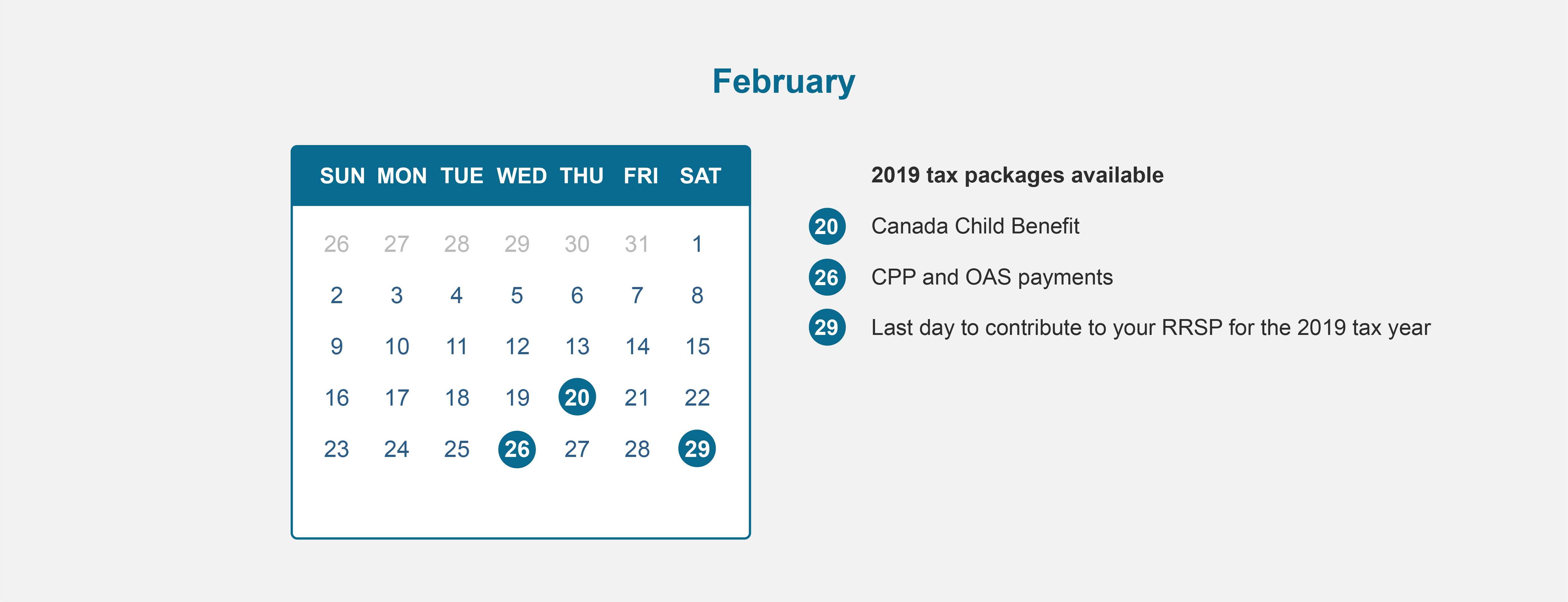

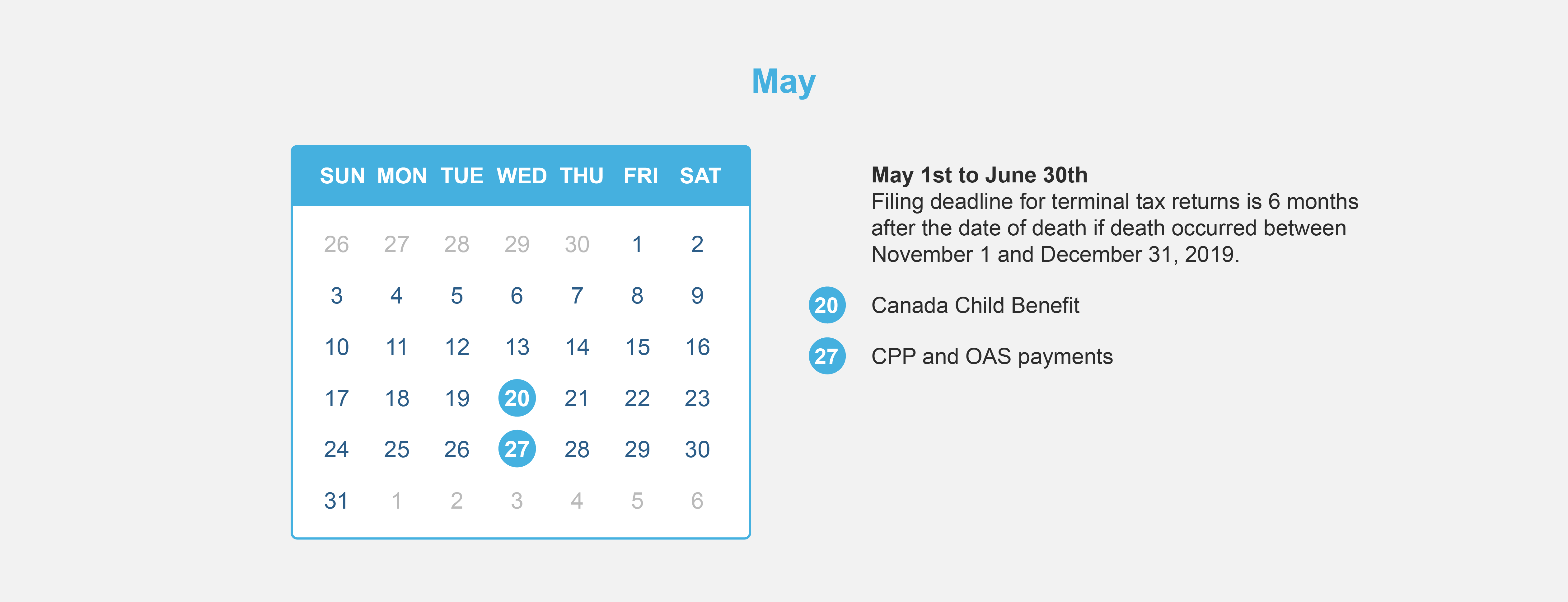

The Government is proposing to increase the maximum annual Canada Child Benefit (CCB) payment amounts, only for the 2019-20 benefit year, by $300 per child. The overall increase for families receiving CCB will be approximately $550 on average; these families will receive an extra $300 per child as part of their May payment.

Together, the proposed enhancements of the GSTC and CCB will give a single parent with two children and low to modest income nearly $1,500 in additional short-term support.

Retirees

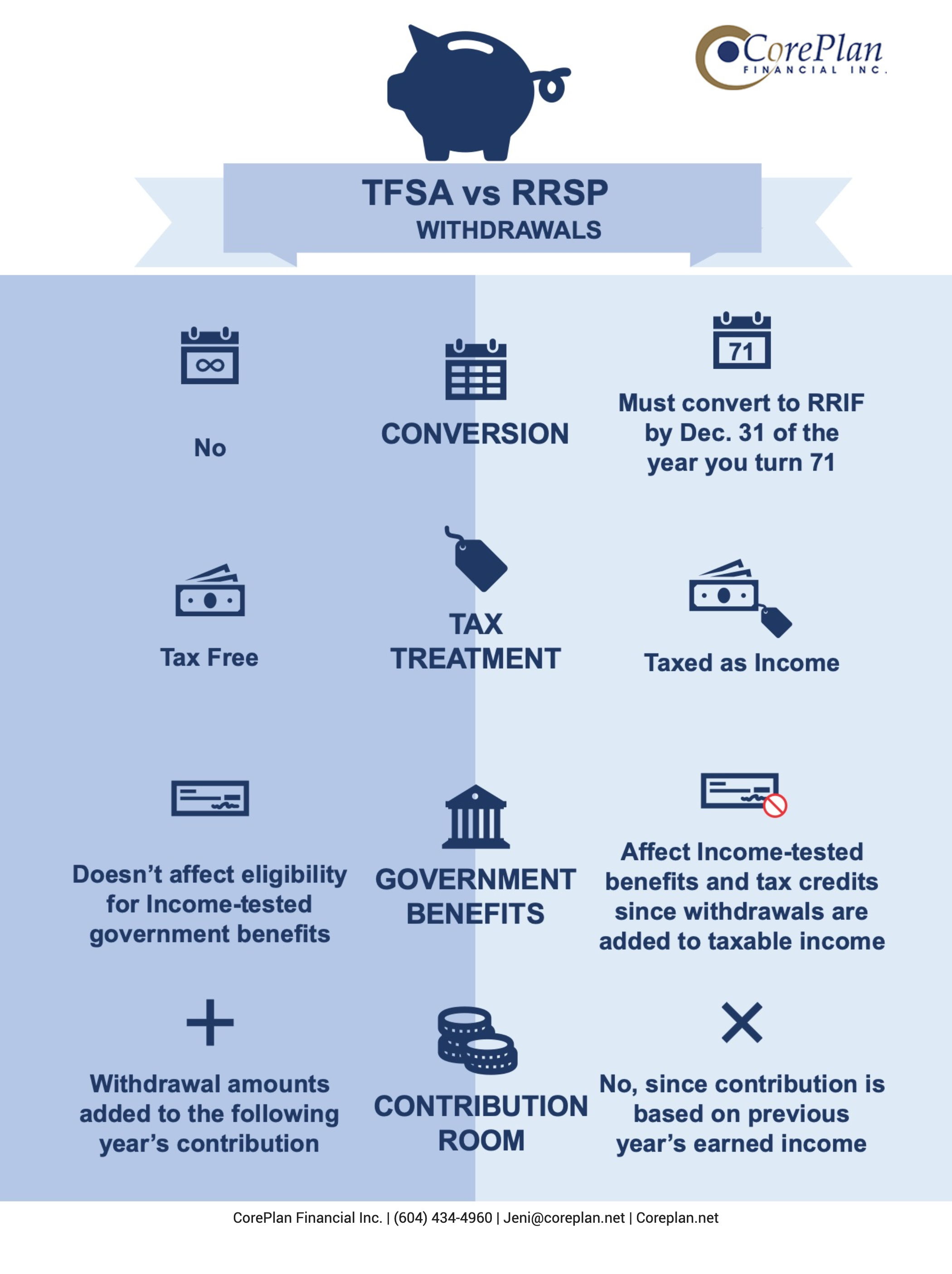

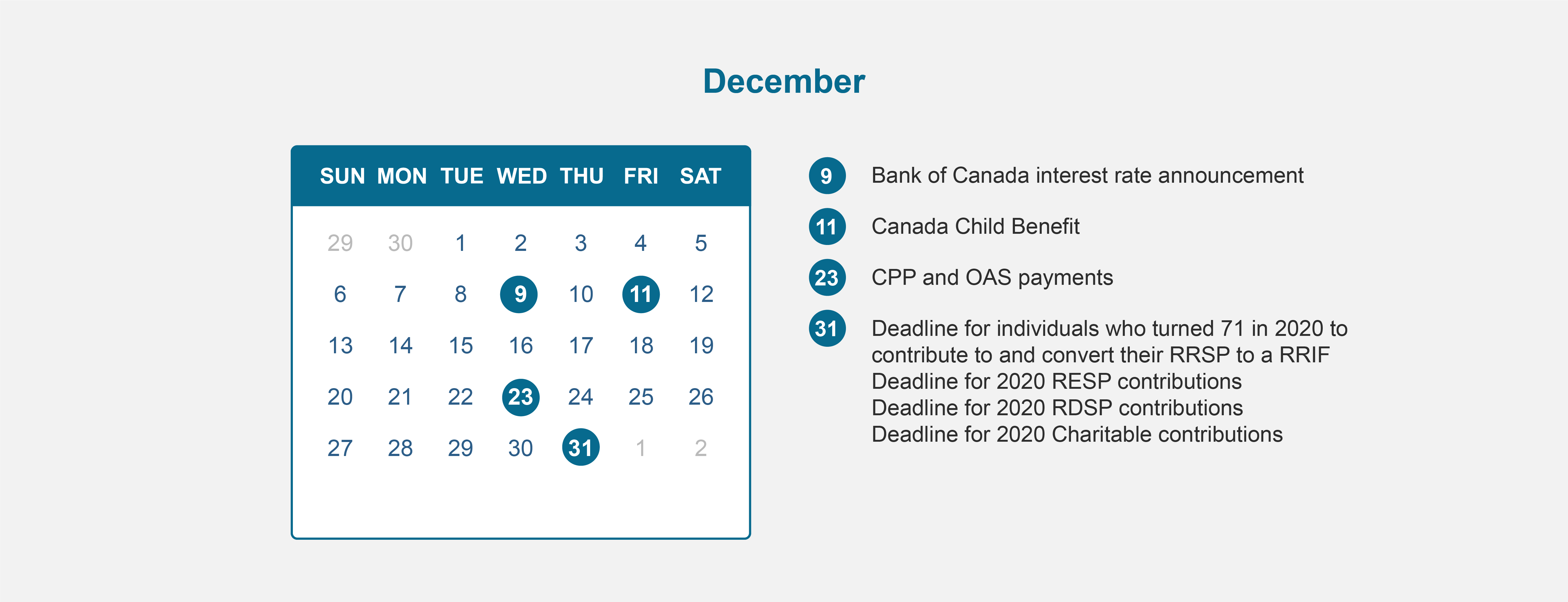

For Retirees, the required minimum withdrawals from Registered Retirement Income Funds (RRIFs) will be reduced by 25% for 2020, in recognition of volatile market conditions and their impact on many seniors’ retirement savings.

Students

6 month interest-free moratorium on the repayment of Canada Student Loans for all individuals currently in the process of repaying these loans.

Tax Filing Deadline deferred

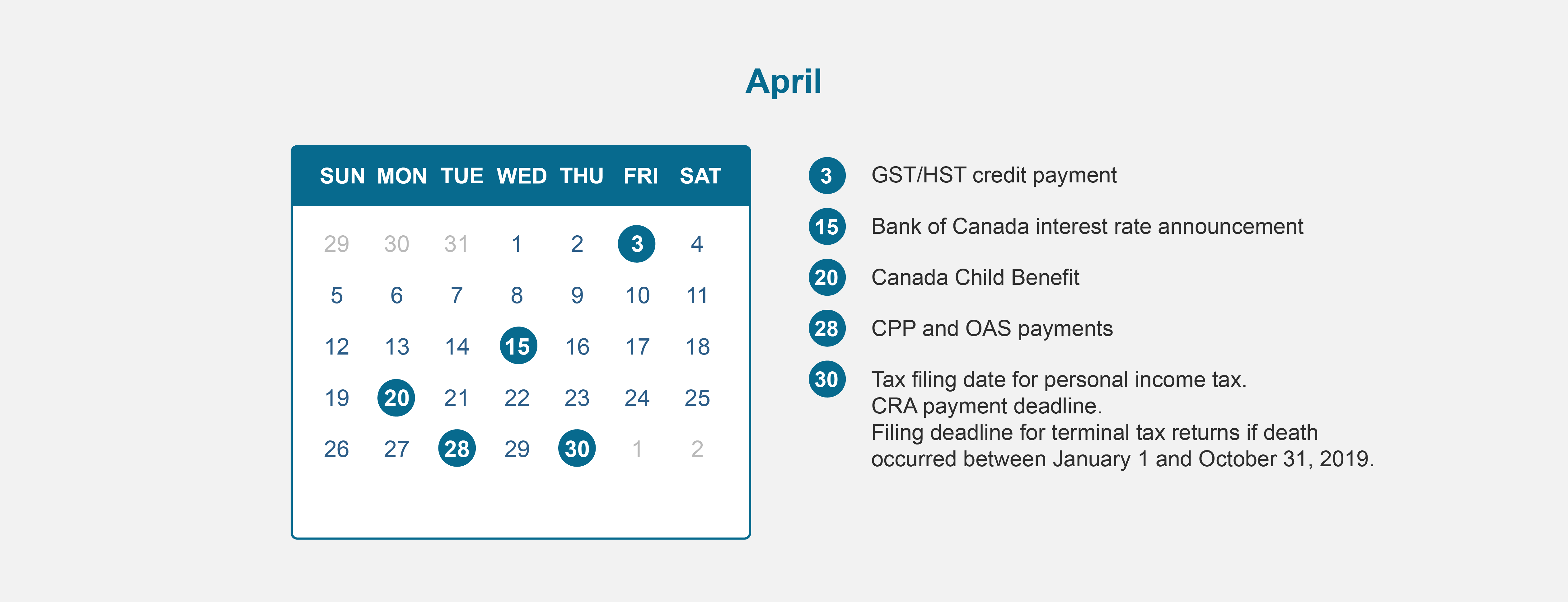

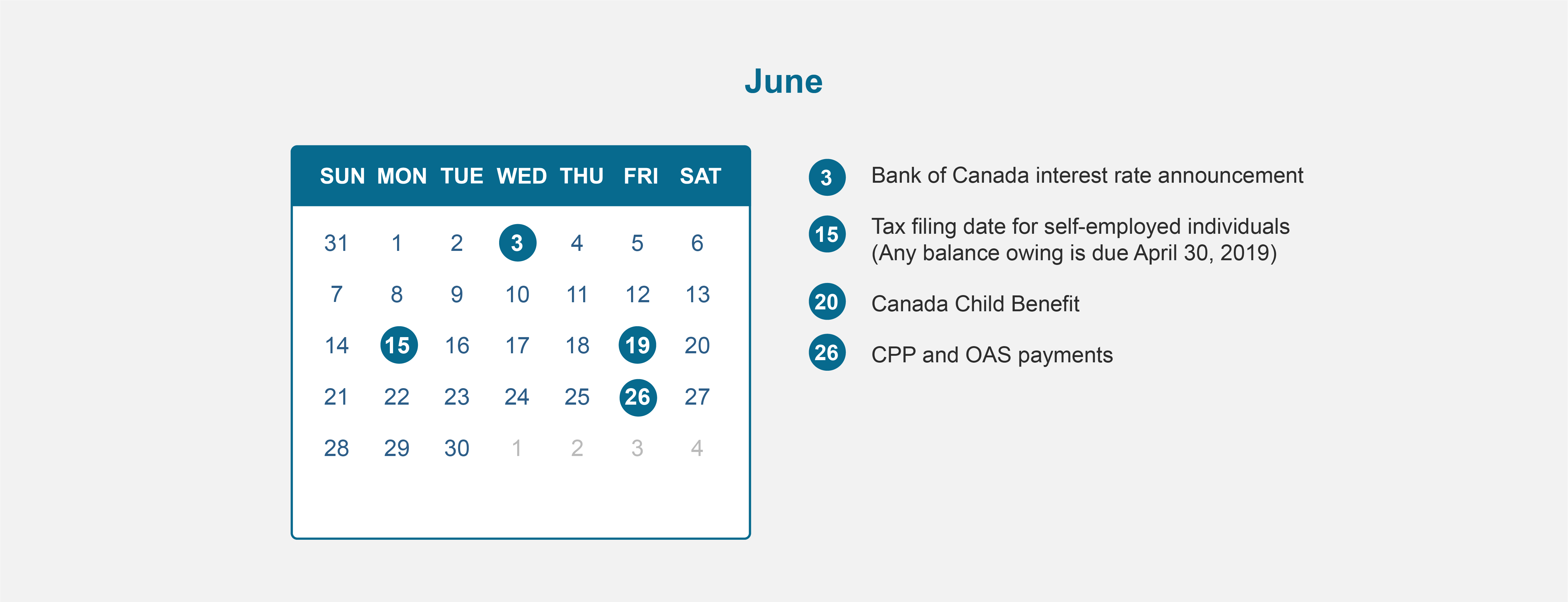

For individuals (other than trusts), the return filing due date will be deferred until June 1, 2020. However, the Agency encourages individuals who expect to receive benefits under the GSTC or the Canada Child Benefit not to delay the filing of their return to ensure their entitlements for the 2020-21 benefit year are properly determined.

For trusts having a taxation year ending on December 31, 2019, the return filing due date will be deferred until May 1, 2020.

The Canada Revenue Agency will allow all taxpayers to defer, until after August 31, 2020, the payment of any income tax amounts that become owing on or after today and before September 2020. This relief would apply to tax balances due, as well as instalments, under Part I of the Income Tax Act. No interest or penalties will accumulate on these amounts during this period.

For Tax preparers and Taxpayers to reduce the need to meet, Digital Signatures will be accepted.

Mortgage Payment Deferral

Canada’s large banks have confirmed that this support will include up to a 6-month payment deferral for mortgages, and the opportunity for relief on other credit products.

To Support Businesses

Helping Businesses Keep their Workers

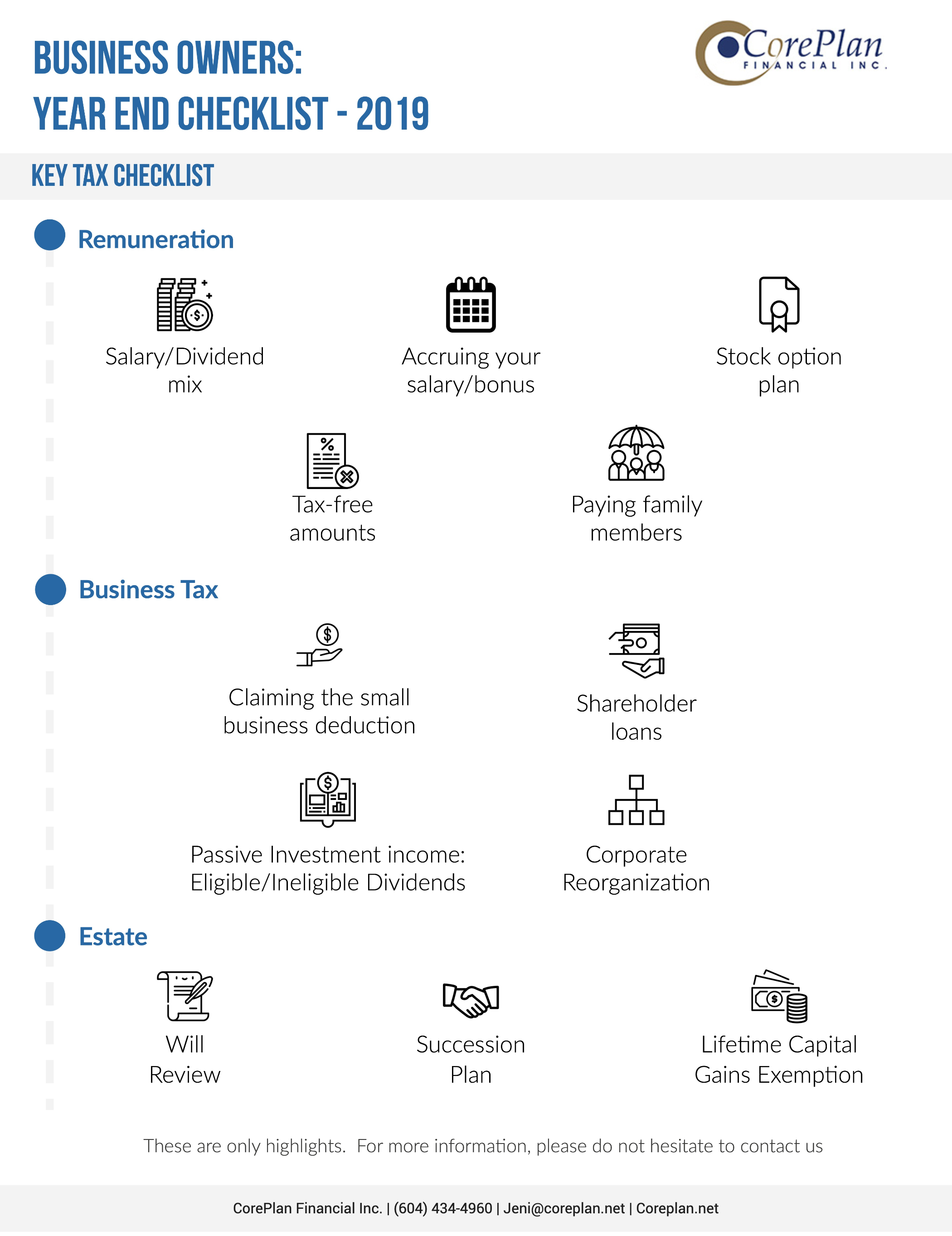

To support businesses that are facing revenue losses and to help prevent lay-offs, the government is proposing to provide eligible small employers a temporary wage subsidy for a period of three months. The subsidy will be equal to 10% of remuneration paid during that period, up to a maximum subsidy of $1,375 per employee and $25,000 per employer. Businesses will be able to benefit immediately from this support by reducing their remittances of income tax withheld on their employees’ remuneration. Employers benefiting from this measure will include corporations eligible for the small business deduction, as well as non-profit organizations and charities.

Flexibility for Businesses Filing Taxes

The Canada Revenue Agency will allow all businesses to defer, until after August 31, 2020, the payment of any income tax amounts that become owing on or after today and before September 2020. This relief would apply to tax balances due, as well as instalments, under Part I of the Income Tax Act. No interest or penalties will accumulate on these amounts during this period.

The Canada Revenue Agency will not contact any small or medium (SME) businesses to initiate any post assessment GST/HST or Income Tax audits for the next four weeks. For the vast majority of businesses, the Canada Revenue Agency will temporarily suspend audit interaction with taxpayers and representatives.

Financing for Businesses

The BDC provides financing for:

-

Small Business Loans – up to $100,000 can be obtained online – here

-

Get extra funds to bridge cash flow gaps and support daily operations with Working Capital Loans

-

Increase your cash flow to fulfill domestic or international orders with Purchase Order Financing