As a business owner, managing your finances well can make a big difference for your business’s future. Whether it’s choosing how to compensate yourself or making the most of opportunities like the small business deduction and lifetime capital gains exemption, thoughtful planning can help you save on taxes. This guide offers practical tips to help you make informed decisions.

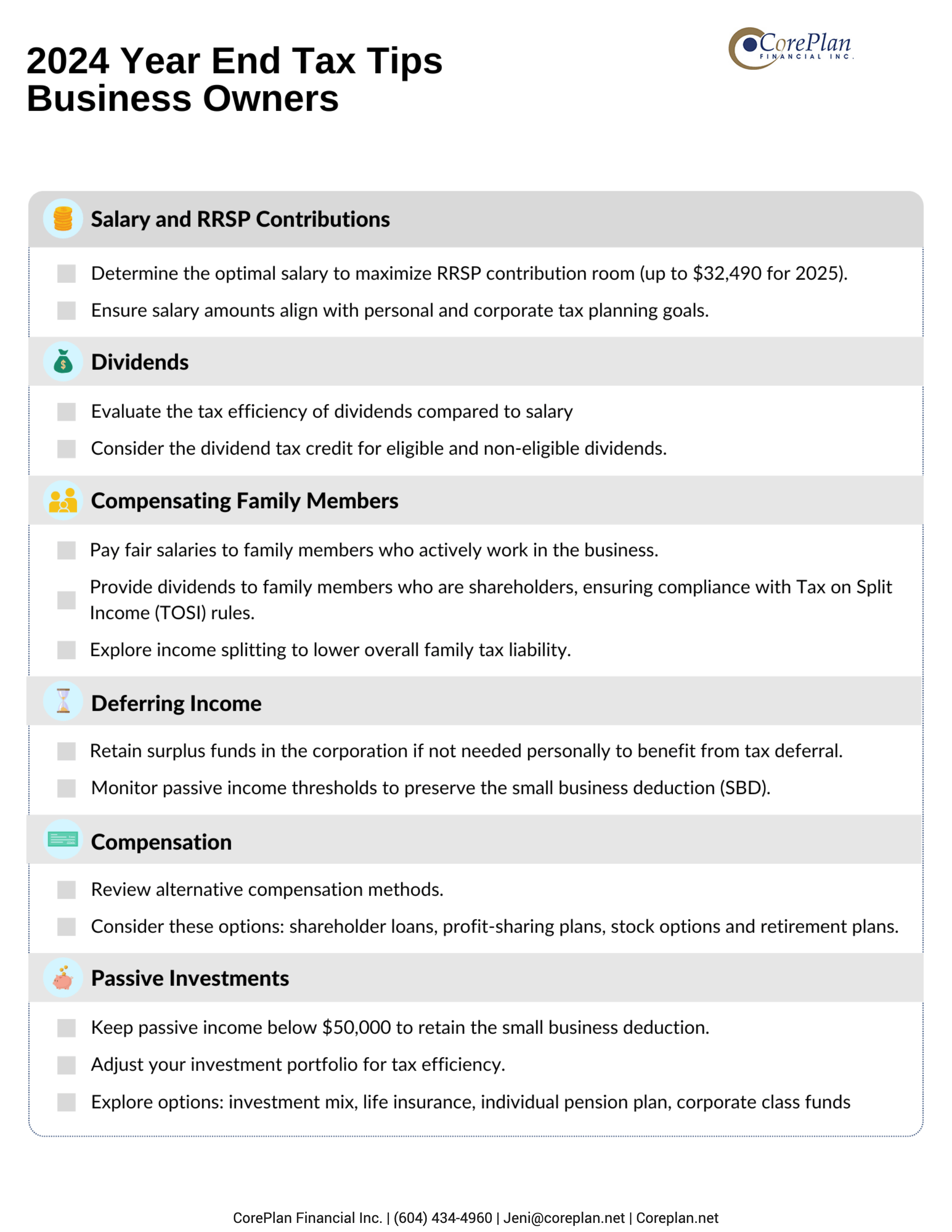

Salary and RRSP Contributions

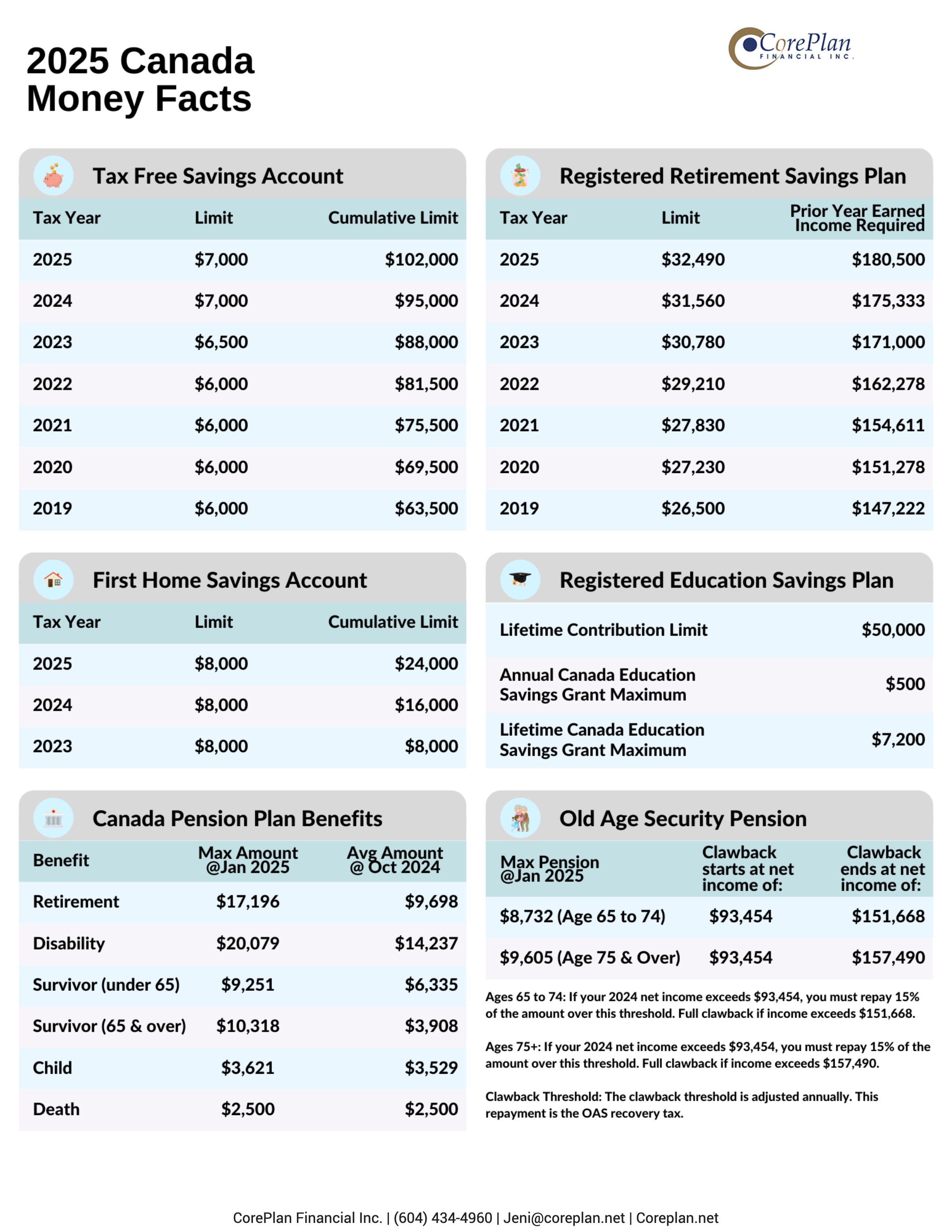

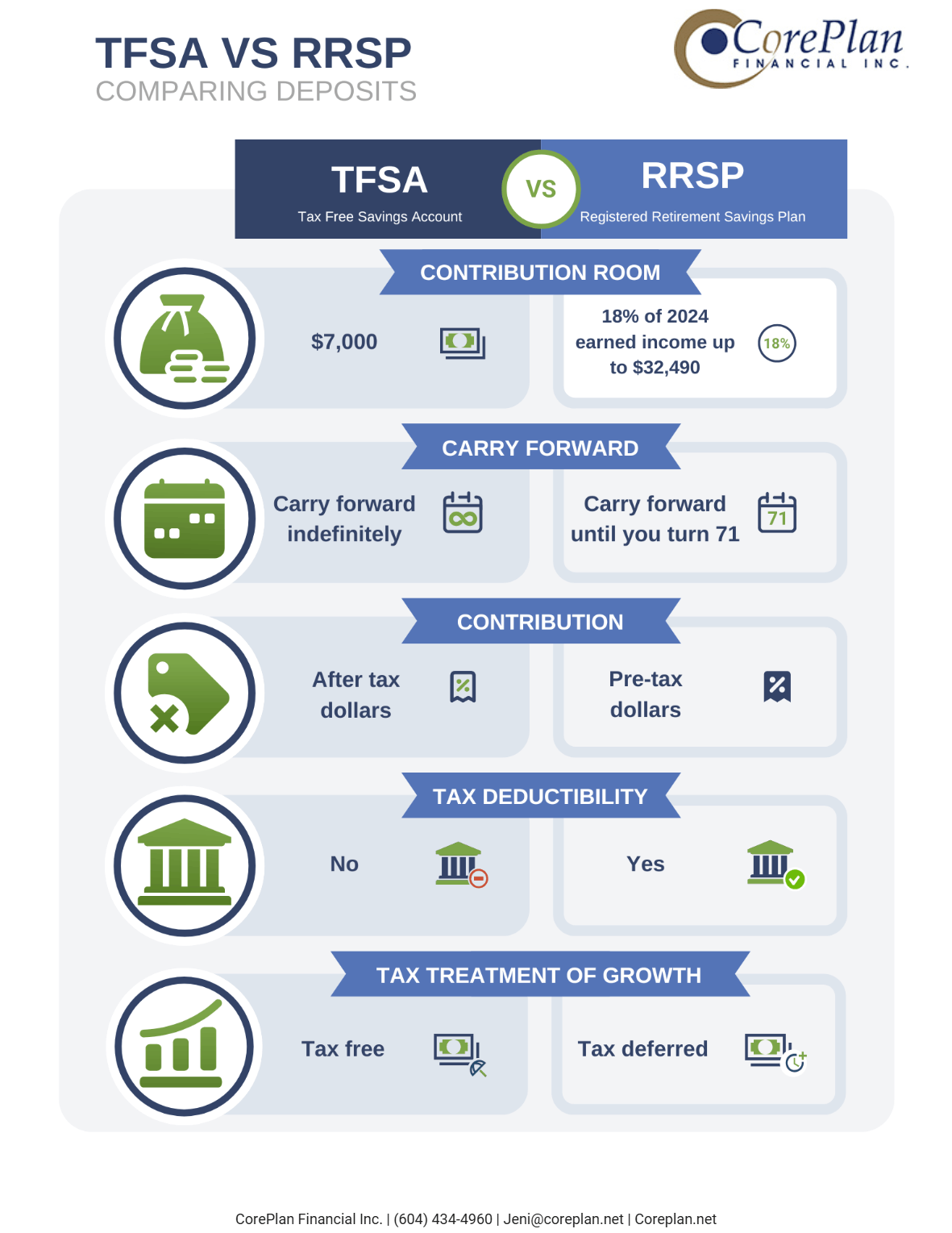

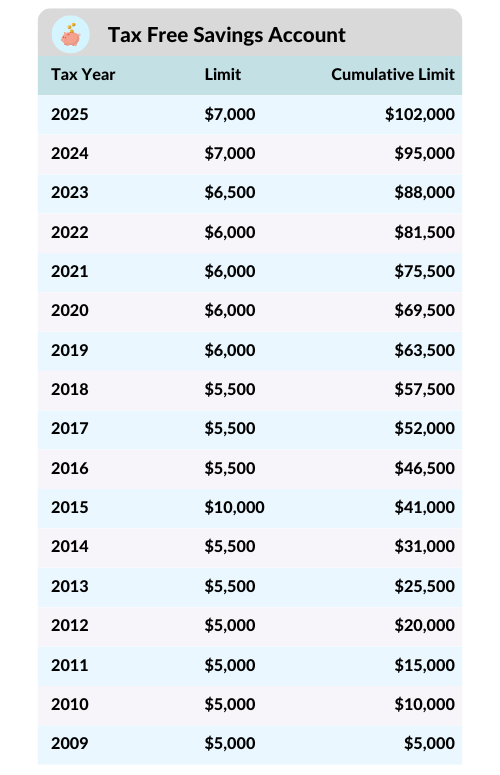

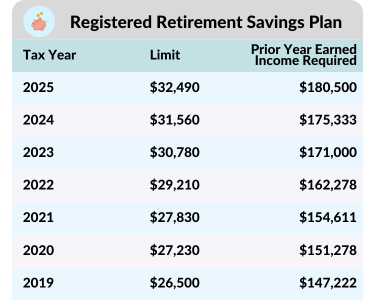

Taking a salary from your corporation can help reduce the company’s taxable income while creating RRSP contribution room for you. In 2024, a salary of up to $180,500 allows you to maximize your RRSP contribution room for 2025, which is $32,490.

Dividends

Dividends offer another way to take income from your business. They’re paid from the corporation’s after-tax income, but thanks to the dividend tax credit, they’re often taxed at a lower rate than salary.

Compensating Family Members

If family members are involved in your business, paying them can be a practical and tax-efficient option:

-

Salaries to Family Members: Paying a fair salary to family members who work for your business not only compensates them but also gives them access to RRSP contributions and CPP. You must be able to prove the family members have provided services in line with the amount of compensation you give them.

-

Dividends to Family Members: If family members are shareholders, dividends can provide them with tax-efficient income. The tax-free amount varies by province or territory, so it’s worth checking the rules where you live.

-

Income Splitting: Distributing income among family members can help reduce overall taxes. However, be mindful of the Tax on Split Income (TOSI) rules to avoid penalties. A tax professional can guide you through this process.

Deferring Income

If you don’t need the full amount for personal use, leaving surplus funds in the corporation could be a smart move. This keeps the money invested within the business, benefiting from lower corporate tax rates. Over time, this approach may allow the funds to generate more income compared to personal investing, depending on your goals and investment strategy. However, be mindful of passive investment income limits, as exceeding $50,000 in passive income could reduce or eliminate your corporation’s access to the small business deduction. Monitoring this threshold is essential to maintaining the tax advantages available to your business.

Compensation

It’s always a good idea to review how you handle compensation beyond base salary.

Consider these options:

-

Shareholder Loans: Borrow funds from your corporation with deductible interest but ensure repayment to avoid personal tax.

-

Profit-Sharing Plans: These can be a tax-efficient alternative to bonuses for distributing profits.

-

Stock Options: Only the employee or employer—not both—can claim a deduction when options are cashed out.

-

Retirement Plans: Explore setting up a Retirement Compensation Arrangement (RCA) to save for retirement tax-efficiently.

Passive Investments

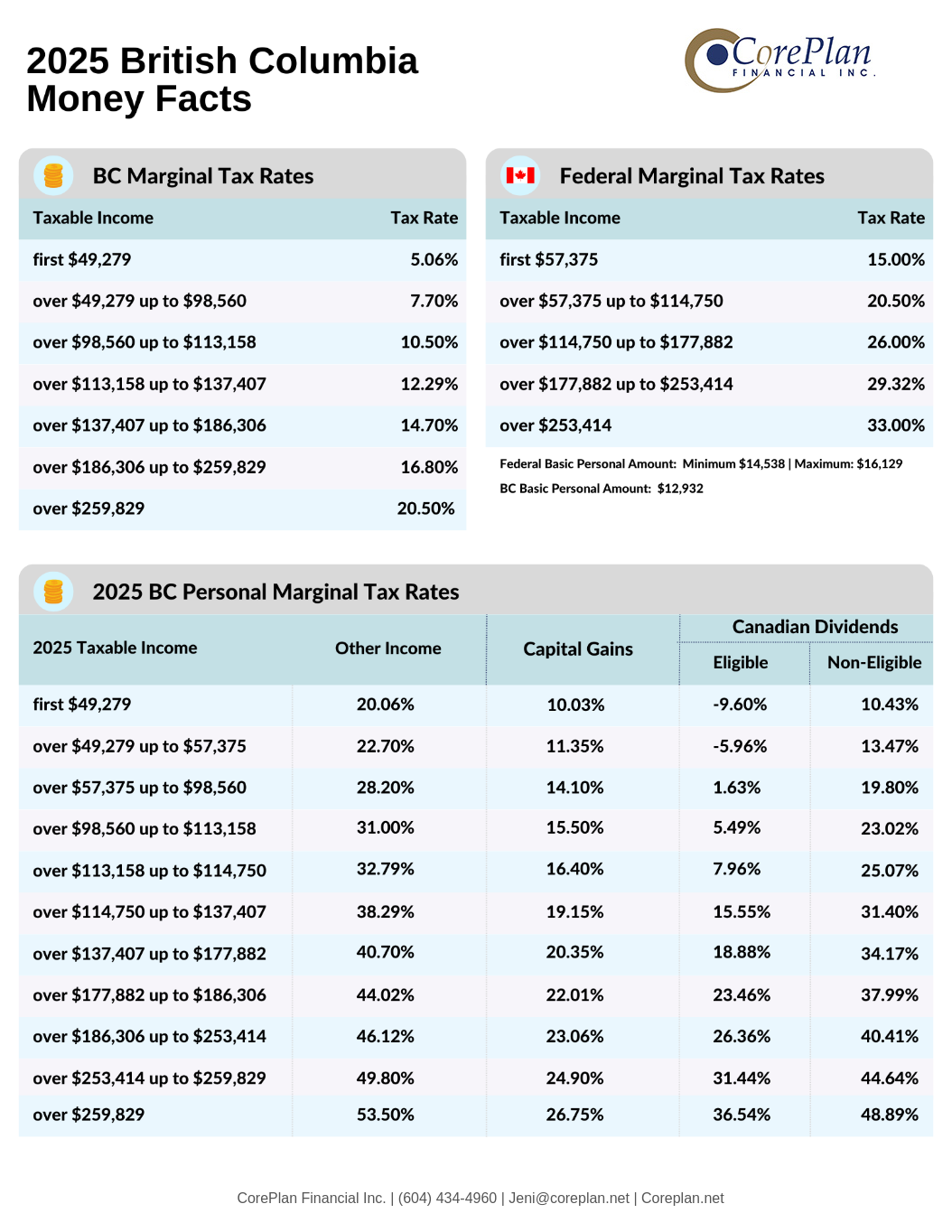

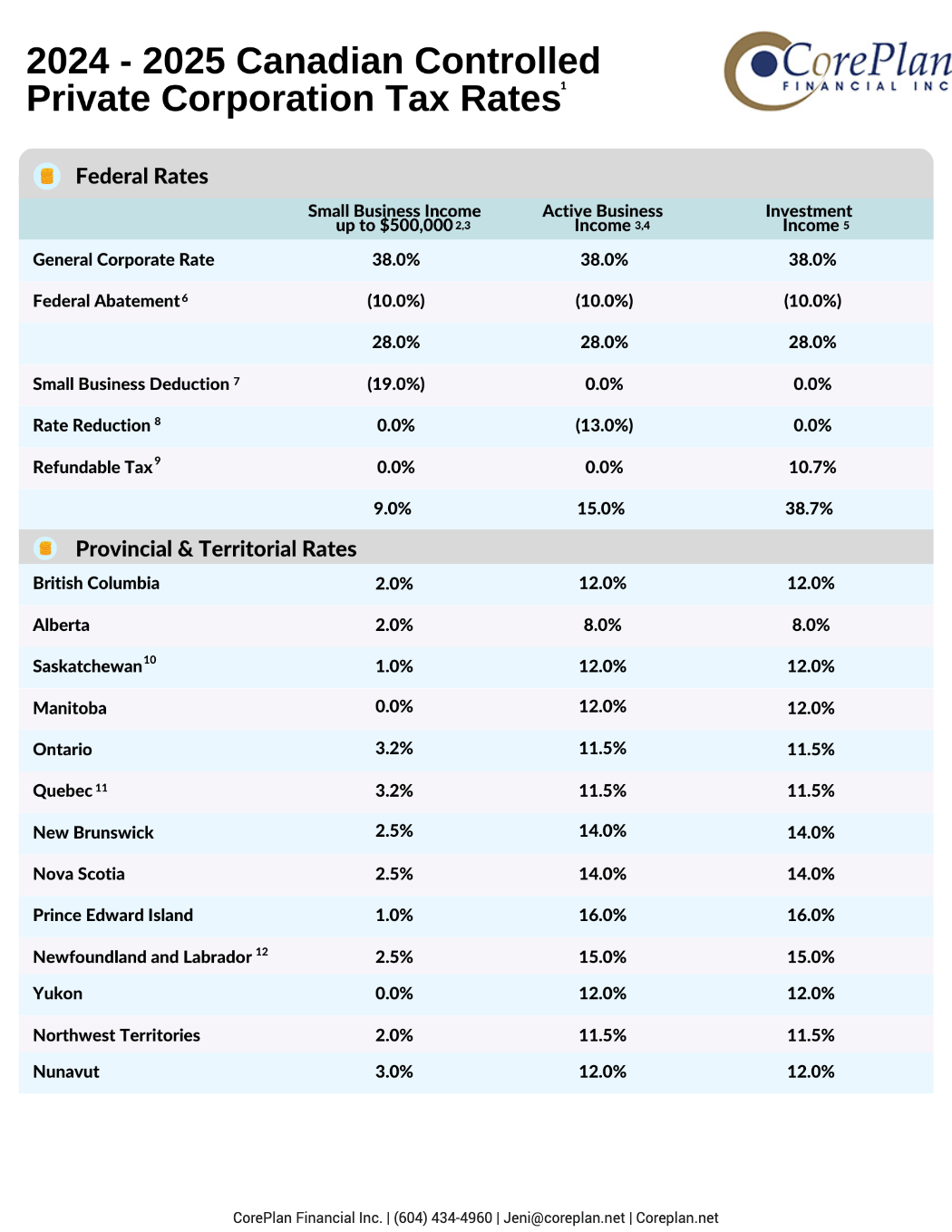

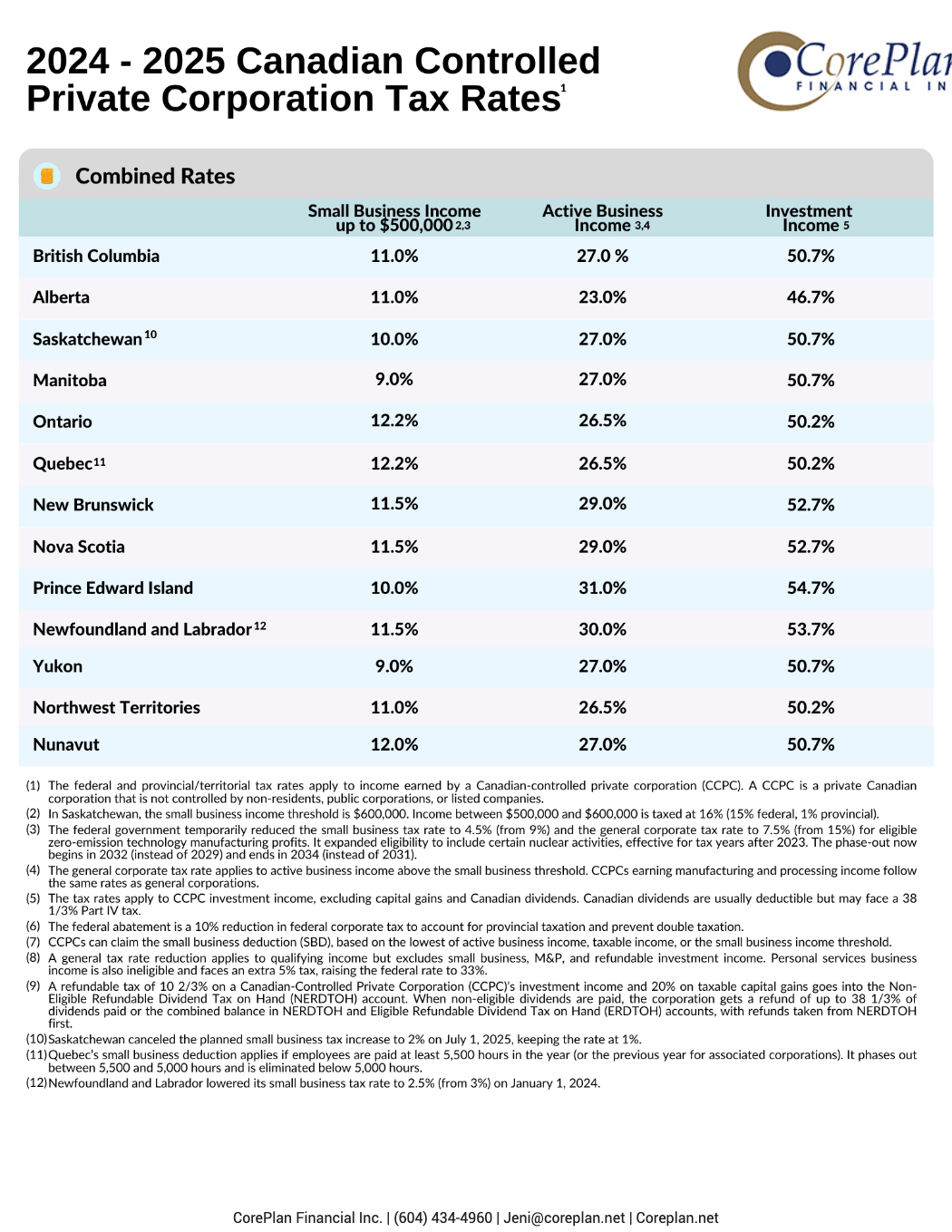

Canadian-controlled private corporations (CCPCs) benefit from a reduced corporate tax rate on the first $500,000 of active business income, thanks to the small business deduction (SBD). The SBD can lower the tax rate by 12% to 21%, depending on your province or territory.

However, passive investment income over $50,000 in the previous year reduces the SBD by $5 for every additional dollar, potentially eliminating it altogether. To maintain access to the SBD, it’s important to keep passive investment income below this threshold.

Here are some strategies to help preserve your SBD:

-

Defer Portfolio Sales: Delay selling investments that generate capital gains if possible.

-

Optimize Your Investment Mix: Focus on tax-efficient investments like equities over fixed income.

-

Exempt Life Insurance Policies: Income earned within these policies isn’t included in your passive investment total.

-

Individual Pension Plan (IPP): This defined benefit plan is exempt from passive income rules and offers tax-advantaged retirement savings.

-

Consider Corporate Class Mutual Funds: These funds offer tax-efficient growth by deferring taxable distributions. While recent tax changes have limited their benefits, they remain a viable option for minimizing taxable passive income.

Carefully managing passive investments can help your business maintain access to the SBD and maximize its tax advantages for continued growth.

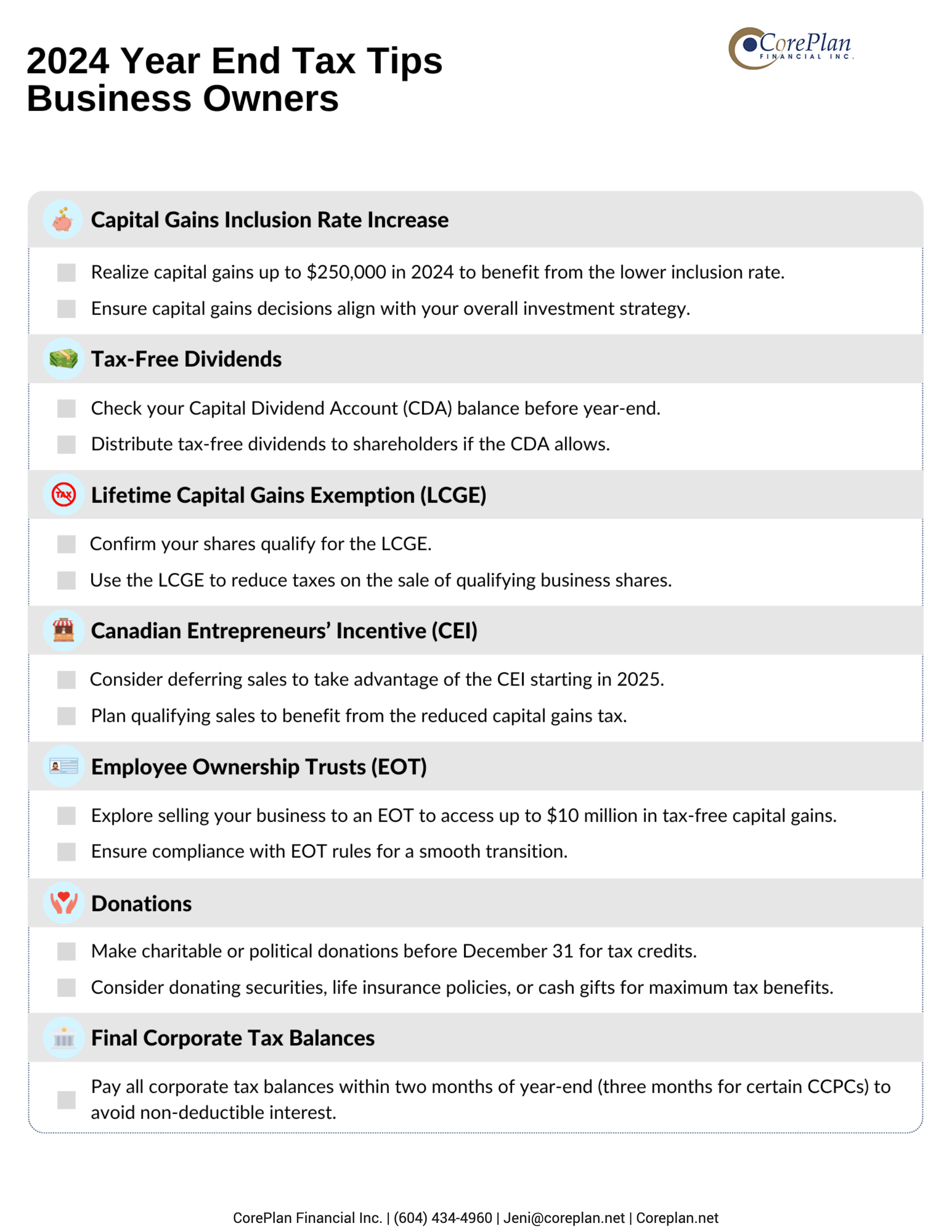

Capital Gains Inclusion Rate Increase

With recent changes to the capital gains inclusion rate, business owners personally holding investments with unrealized gains may want to consider realizing up to $250,000 in capital gains in 2024. This approach allows you to benefit from the lower tax rate on gains within this threshold, provided it aligns with your overall financial strategy.

Tax-Free Dividends

If your corporation has investments with losses that haven’t been sold yet, it’s a good idea to check the balance of its Capital Dividend Account (CDA) before selling. The CDA keeps track of the non-taxable portion of capital gains and some other amounts. You can pay tax-free dividends to shareholders using this account if you don’t go over the balance. However, if you sell investments at a loss, the CDA balance will go down, which might reduce or even remove your ability to pay these tax-free dividends. To avoid this, think about paying out any available tax-free dividends before selling investments at a loss.

Business Transition

If you’re planning to transition your business and believe its value has decreased, now might be a good time to explore options like an estate freeze or refreeze as part of your strategy.

Lifetime Capital Gains Exemption (LCGE)

The 2024 Federal Budget increased the LCGE from $1,016,836 to $1.25 million as of June 25, 2024. This allows you to benefit from tax savings on up to $1.25 million in capital gains over your lifetime when selling qualifying small business shares, farm properties, or fishing properties. Ensuring your corporate shares qualify for this exemption can help reduce the tax burden when selling or transferring your business.

Canadian Entrepreneurs’ Incentive (CEI)

The 2024 Federal Budget also introduced the Canadian Entrepreneurs’ Incentive (CEI) to lower taxes on selling qualifying shares. Starting June 25, 2024, the CEI reduces the taxable portion of capital gains to one-third for gains over $250,000 on qualifying sales.

In 2025, the CEI will go even further, lowering the taxable portion of capital gains to half the usual amount for up to $2 million in lifetime gains. This $2 million limit will start at $400,000 in 2025 and increase by $400,000 each year until it reaches $2 million in 2029.

To use the CEI, the shares must meet certain rules. However, it does not apply to shares of professional corporations or businesses focused on financial services, insurance, real estate, food and accommodation, arts, recreation, entertainment, consulting, or personal care services.

Together, the LCGE and CEI offer tax savings for business owners when selling or passing on their businesses.

Employee Ownership Trusts (EOT)

An EOT is a way for employees to own a business. A trust holds shares of the business on behalf of the employees, so they don’t have to pay directly to buy shares themselves.

Starting in 2024, EOTs are allowed in Canada. If a business is sold to an EOT in 2024, 2025, or 2026, the first $10 million in capital gains from the sale is tax-free, if certain conditions are met. This $10 million limit applies to the entire business, not to each individual shareholder. If multiple people sell shares to an EOT as part of the sale, they can each claim part of the exemption, but the total claimed by everyone combined can’t be more than $10 million. All sellers must agree on how to split the exemption.

Depreciable Assets

Purchasing depreciable assets can be a smart tax planning move, as they allow you to claim Capital Cost Allowance (CCA) to reduce taxable income.

To maximize the benefits:

-

Take advantage of the Accelerated Investment Incentive, which offers an enhanced first-year CCA for eligible assets.

-

Postpone selling depreciable assets if it could trigger recaptured depreciation in your 2024 tax year.

Timing your asset purchases and sales can help optimize your tax savings.

Donations

Making donations, whether charitable or political, can provide valuable tax benefits. To maximize these advantages, consider options like:

-

Donating securities

-

Giving a direct cash gift to a registered charity

-

Using a donor-advised fund for ongoing charitable contributions

-

Setting up a private foundation

-

Donating a life insurance policy by naming a charity as the beneficiary or transferring ownership.

Each option offers unique tax advantages depending on your situation.

Final Corporate Tax Balances

Pay your corporate taxes within two months of year-end (or three months for some CCPCs) to avoid interest charges that can’t be deducted.

Contact Us

For guidance on implementing these strategies, connect with your trusted tax professional. If you’d like to discuss how these tips align with your overall plan, let’s schedule a meeting.

Sources:

CPA Canada, “2024 Federal Budget Highlights,” https://www.cpacanada.ca/-/media/site/operational/sc-strategic-communications/docs/02085-sc_2024-federal-budget-highlights_en_final.pdf?rev=6d565a6a66ef4e20b1e01dc784464c93, 2024.

Government of Canada, “Capital Gains Inclusion Rate,” https://www.canada.ca/en/department-finance/news/2024/06/capital-gains-inclusion-rate.html, 2024.

Advisor.ca, “Lifetime Capital Gains Exemption to Top $1M in 2024,” https://www.advisor.ca/tax/tax-news/lifetime-capital-gains-exemption-to-top-1m-in-2024/, 2024.

PwC Canada, “Year-End Tax Planner,” https://www.pwc.com/ca/en/services/tax/publications/guides-and-books/year-end-tax-planner.html, 2024.

CIBC, “2024 Year-End Tax Tips,” https://www.cibc.com/content/dam/personal_banking/advice_centre/tax-savings/year-end-tax-tips-en.pdf, 2024.

Government of Canada, “Federal Budget 2024,” https://budget.canada.ca/2024/report-rapport/tm-mf-en.html, 2024.

-CorePlan-Financial%20Inc.-KeaDeGTTWDWwPNKPB.png)

-CorePlan-Financial%20Inc.-KeaDeGTTWDWwPNKPB.png)