2025 Financial Calendar

-CorePlan-Financial%20Inc.-KeaDeGTTWDWwPNKPB.png)

-CorePlan-Financial%20Inc.-KeaDeGTTWDWwPNKPB.png)

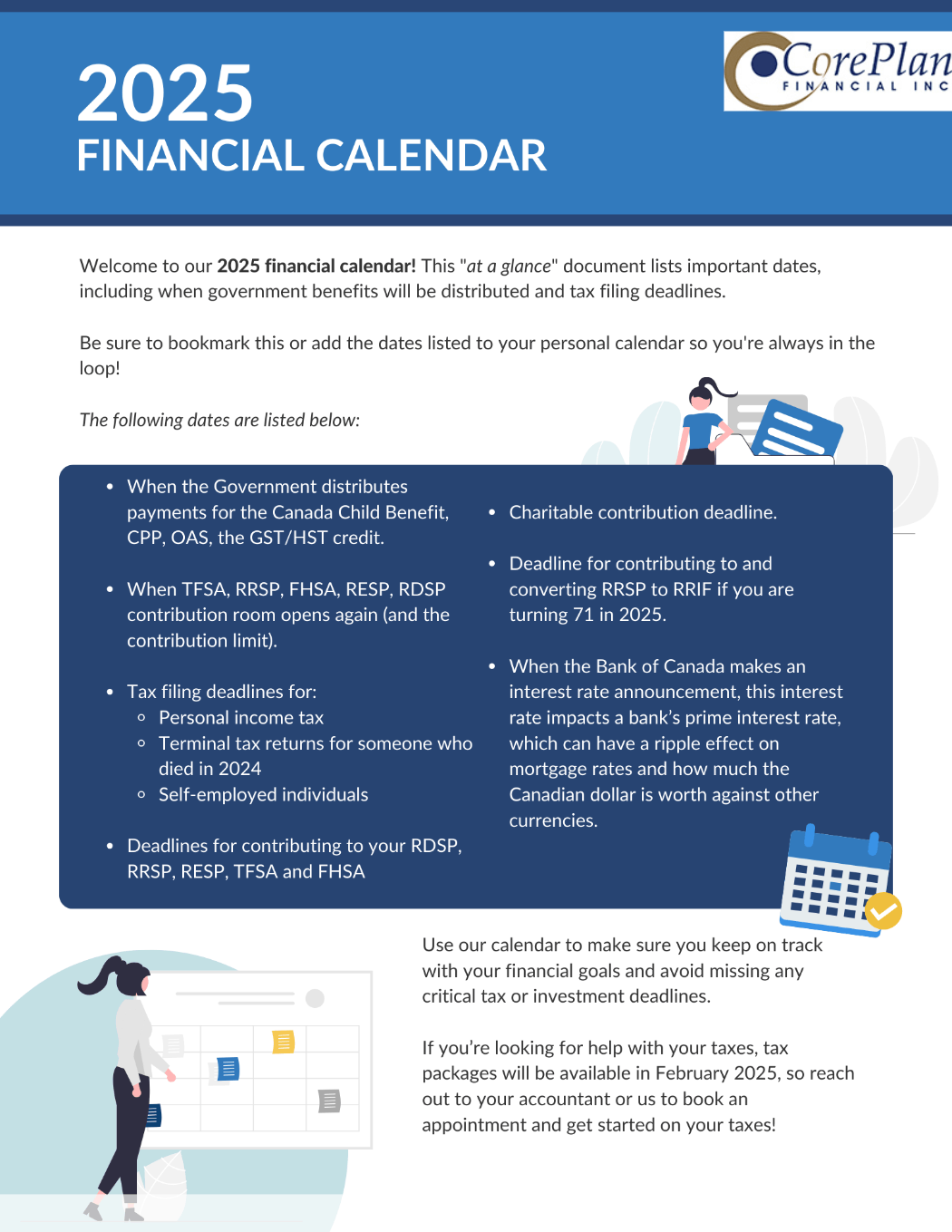

Welcome to our 2025 financial calendar! This calendar is designed to help you keep track of important financial dates and deadlines, such as tax filing and government benefit distribution. You can bookmark this page for easy reference or add these dates to your personal calendar to ensure you don’t miss any important financial obligations.

If you need help with your taxes, tax packages will be available starting February 2024. Don’t wait until the last minute to get started on your tax return – make an appointment with your accountant to ensure you’re ready to go when tax season arrives.

Important 2024 Dates to Know

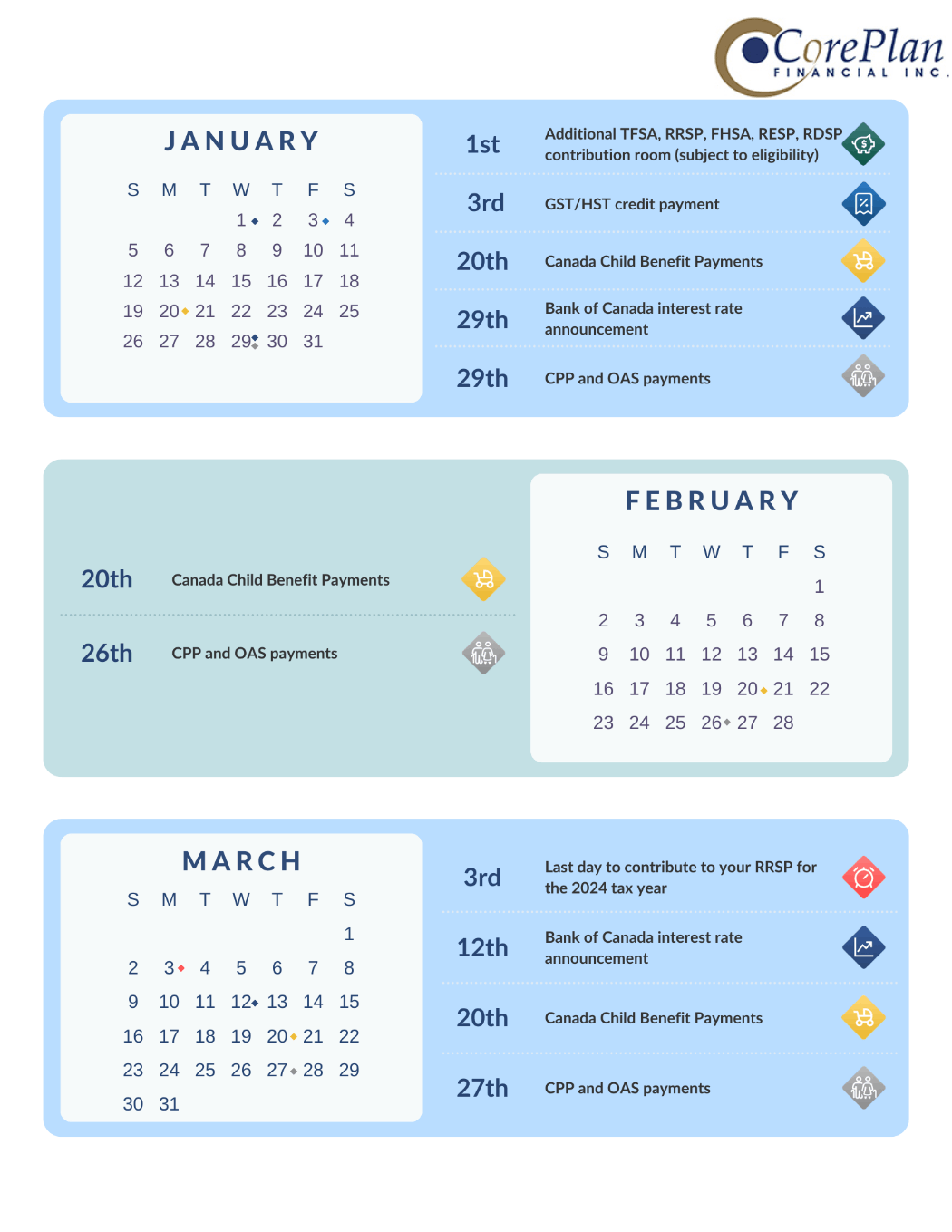

On January 1, 2025, the contribution room for your Tax-Free Savings Account (TFSA) opens again. For those that are eligible, the contribution rooms for your Registered Retirement Savings Plan (RRSP), First Home Savings Account (FHSA), Registered Education Savings Plan (RESP), and Registered Disability Savings Plan (RDSP) will also be available.

For your Registered Retirement Savings Plan contributions to be eligible for the 2024 income tax year, you must make them by March 3, 2025.

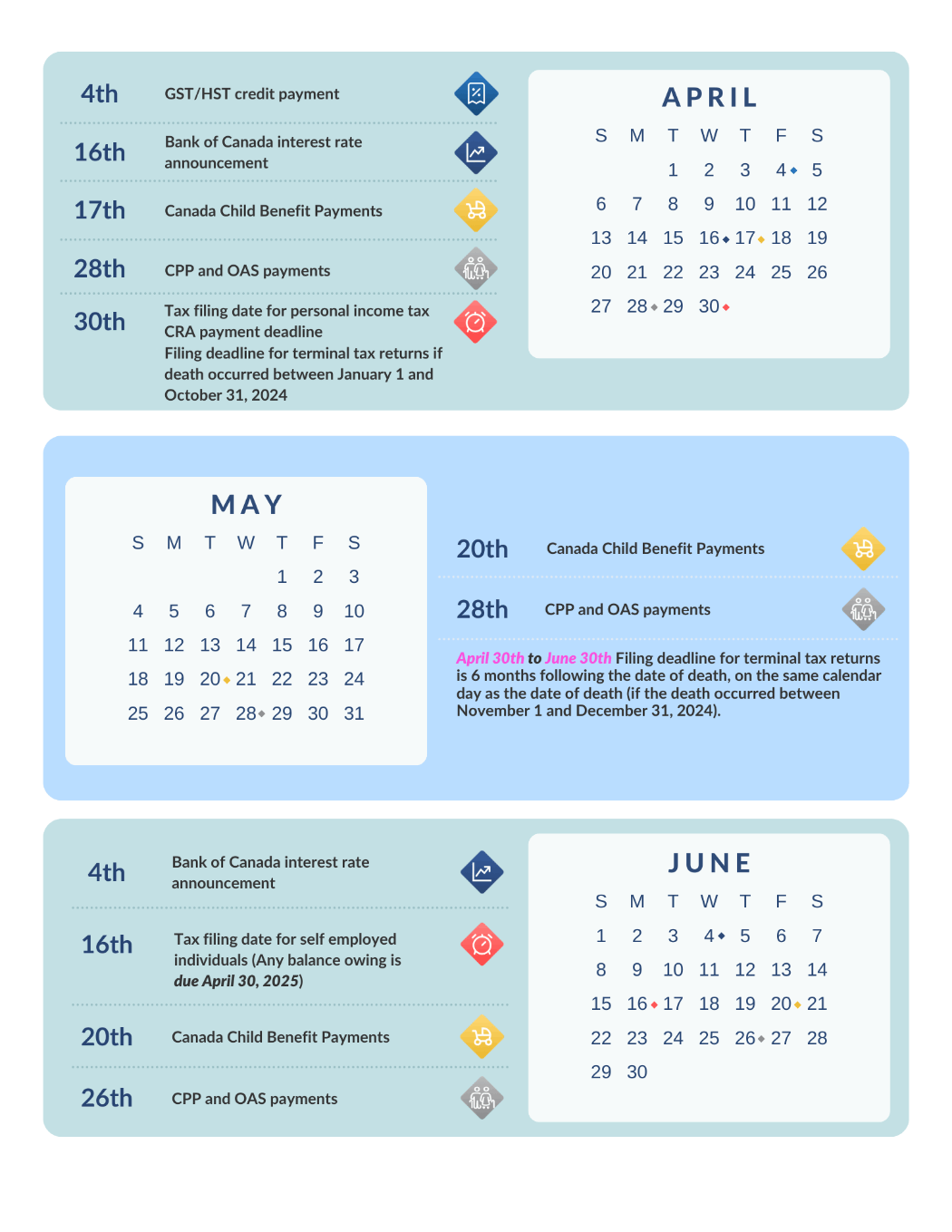

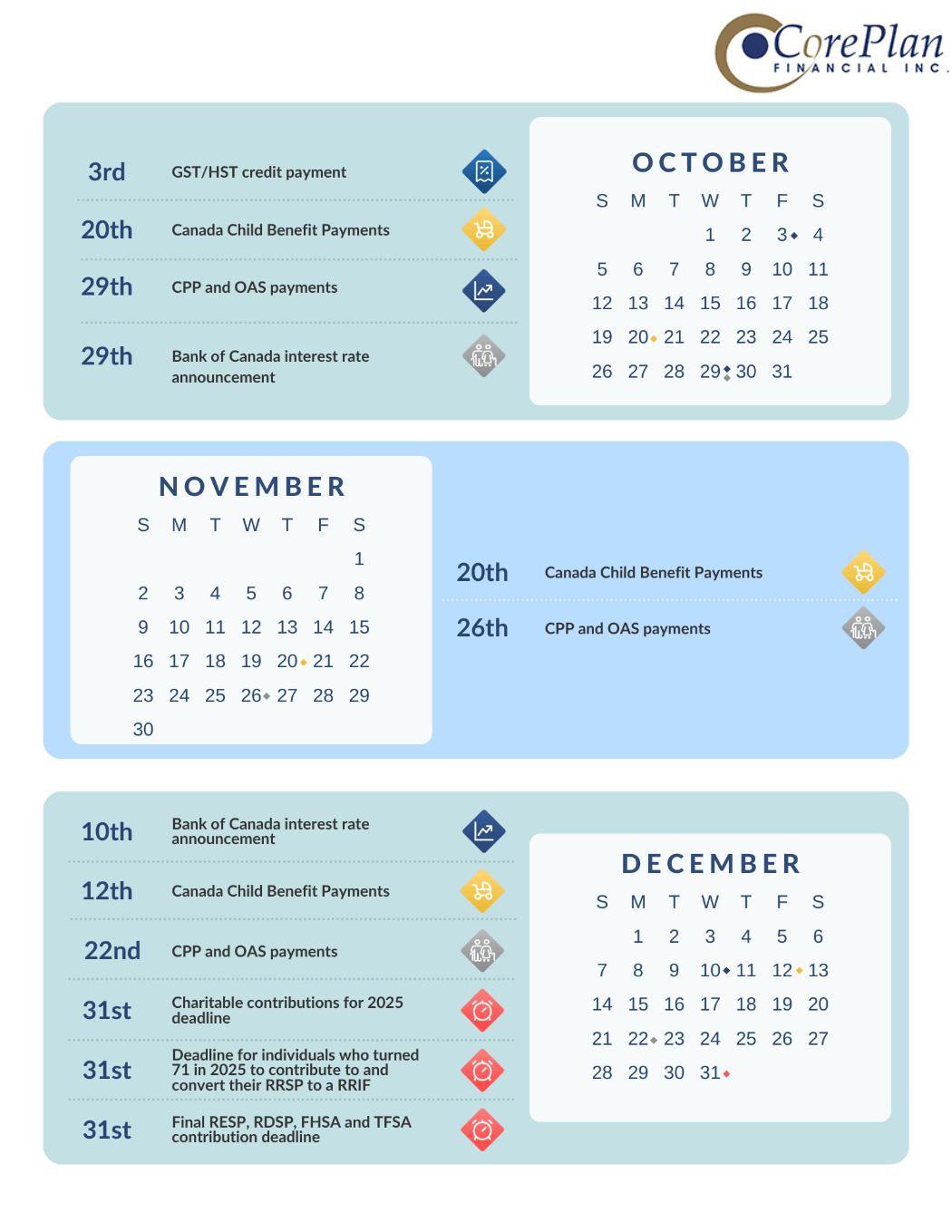

GST/HST credit payments will be issued on:

-

January 3

-

April 4

-

July 4

-

October 3

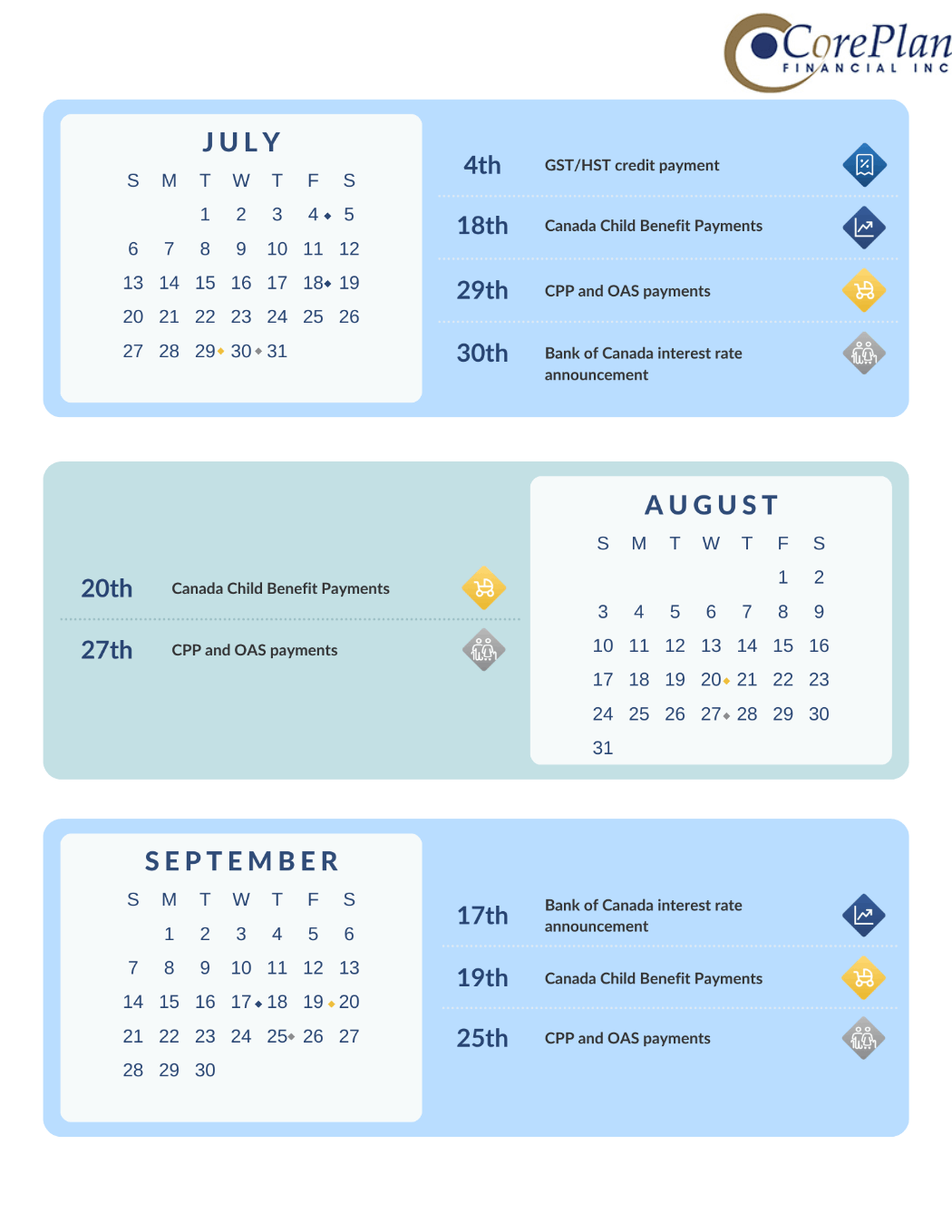

Canada Child Benefit payments will be issued on the following dates:

-

January 20

-

February 20

-

March 20

-

April 17

-

May 20

-

June 20

-

July 18

-

August 20

-

September 19

-

October 20

-

November 20

-

December 12

The government will issue Canada Pension Plan and Old Age Security payments on the following dates:

-

January 29

-

February 26

-

March 27

-

April 28

-

May 28

-

June 26

-

July 29

-

August 27

-

September 25

-

October 29

-

November 26

-

December 22

The Bank of Canada will make interest rate announcements on:

-

January 29

-

March 12

-

April 16

-

June 4

-

July 30

-

September 17

-

October 29

-

December 10

April 30, 2025, is the last day to file your personal income taxes, and tax payments are due by this date. This is also the filing deadline for final returns if death occurred between January 1 and October 31, 2024.

May 1 to June 30, 2025, would be the filing deadline for final tax returns if death occurred between November 1 and December 31, 2024. The due date for the final return is six months after the date of death.

The tax deadline for all self-employment returns is June 16, 2025. Payments are due April 30, 2025.

The final Tax-Free Savings Account, First Home Savings Account, Registered Education Savings Plan and Registered Disability Savings Plan contributions deadline is December 31, 2025.

December 31, 2025 is also the deadline for 2025 charitable contributions.

December 31, 2025 is also the deadline for individuals who turned 71 in 2025 to finish contributing to their RRSPs and convert them into RRIFs.

Please reach out if you have any questions.

Sources:

https://www.canada.ca/en/revenue-agency/services/child-family-benefits/benefit-payment-dates.html

https://www.canada.ca/content/dam/cra-arc/camp-promo/smll-bsnss-wk-e.pdf